Audited financial statements provide an independent verification of a company’s financial health, offering stakeholders assurance of accuracy and compliance. They are essential for transparency and informed decision-making.

What Are Audited Financial Statements?

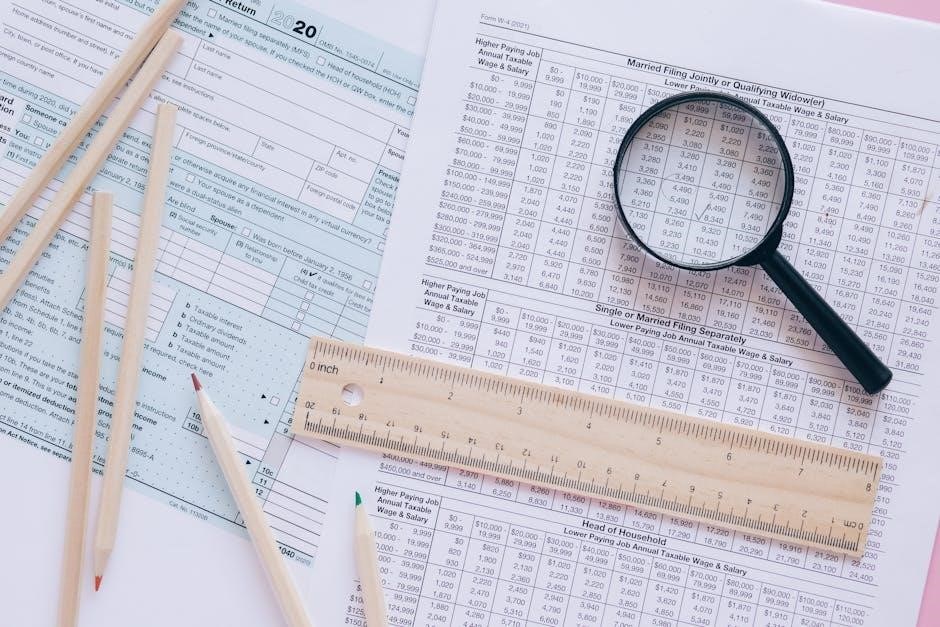

Audited financial statements are official documents that present a company’s financial position, performance, and cash flows, verified by an independent auditor. They include a balance sheet, income statement, cash flow statement, and explanatory notes. The auditor evaluates the fairness and accuracy of these statements, ensuring compliance with accounting standards. The audit process involves examining financial records, transactions, and internal controls to identify material misstatements. The auditor then issues an opinion, which can be unqualified, qualified, adverse, or disclaimed, depending on the findings. These statements are crucial for stakeholders, such as investors, lenders, and regulators, as they provide assurance that the financial information is reliable and free from material errors. Audited financial statements are often required for compliance, financing, or major business transactions.

Importance of Audited Financial Statements

Audited financial statements are crucial for building trust and credibility with stakeholders, including investors, lenders, and regulators. They provide an independent verification of a company’s financial health, ensuring transparency and accountability. By confirming the accuracy of financial data, audited statements reduce the risk of material misrepresentation, which is essential for informed decision-making. They also facilitate access to capital by meeting the requirements of lenders and investors. Additionally, audited statements help in identifying and addressing internal control weaknesses, improving overall governance. For publicly traded companies, they are a legal requirement, ensuring compliance with financial regulations. Overall, audited financial statements are a cornerstone of financial integrity, fostering confidence in the economy and financial markets.

Who Needs Audited Financial Statements?

Audited financial statements are required by various stakeholders to ensure financial transparency and accountability. Publicly traded companies need them to comply with regulatory requirements and maintain investor confidence. Private businesses seeking loans or credit often require audited statements to demonstrate financial stability to lenders. Non-profit organizations and government entities use them to show accountability to donors and taxpayers. Additionally, companies planning mergers or acquisitions must provide audited statements to facilitate smooth transactions. Stakeholders, including shareholders and creditors, rely on these statements to make informed decisions. Overall, any entity requiring external validation of its financial health benefits from audited financial statements, ensuring credibility and trust in their financial reporting.

Key Components of Audited Financial Statements

Audited financial statements include the balance sheet, income statement, cash flow statement, and explanatory notes, providing a comprehensive view of a company’s financial position and performance.

Balance Sheet: Structure and Content

The balance sheet presents a company’s financial position at a specific point in time, detailing assets, liabilities, and equity. It is structured into three main sections: assets, liabilities, and shareholders’ equity. Assets are classified into current and non-current, including items like cash, accounts receivable, inventory, and property. Liabilities are divided into short-term and long-term obligations, such as accounts payable and loans. Equity represents the company’s residual interest, including retained earnings and share capital. The balance sheet adheres to the accounting equation: Assets = Liabilities + Equity. It provides insights into liquidity, solvency, and financial stability, enabling stakeholders to assess the company’s financial health and make informed decisions. Proper classification and disclosure ensure transparency and compliance with accounting standards.

Income Statement: Structure and Content

The income statement, also known as the profit and loss statement, outlines a company’s revenues, expenses, and net income over a specific period. It is divided into key sections: revenue (sales or income), cost of goods sold (COGS), gross profit, operating expenses, and net income. Additional details may include non-operating items, taxes, and earnings per share. This statement provides insight into a company’s profitability and financial performance. Properly structured, it helps stakeholders assess efficiency, cost management, and overall financial health. The income statement is essential for trend analysis and benchmarking, enabling comparisons over time or against industry peers. Its clarity and accuracy are critical for informed decision-making by investors, creditors, and management.

Cash Flow Statement: Structure and Content

The cash flow statement tracks a company’s cash inflows and outflows over a specific period, divided into operating, investing, and financing activities. Operating activities include cash from sales and expenses, while investing activities cover asset purchases or sales. Financing activities involve changes in debt or equity. This statement reveals a company’s liquidity and solvency, showing how cash is generated and used. It complements the balance sheet and income statement by providing insights into cash management and sustainability. A well-structured cash flow statement helps stakeholders assess a company’s ability to meet obligations and fund growth. Its accuracy is crucial for evaluating financial stability and future cash flow potential. Proper categorization ensures clarity and transparency in reporting.

Explanatory Notes: Structure and Content

Explanatory notes provide detailed insights into specific items within the financial statements, enhancing transparency and understanding. They clarify accounting policies, disclose contingent liabilities, and explain significant transactions. These notes are structured to follow the sequence of the financial statements, offering context to figures presented. They include management’s discussions on financial performance, risks, and uncertainties. Notes also outline segment reporting, revenue recognition methods, and debt obligations. Their purpose is to address complexities that may not be evident from the statements alone, ensuring stakeholders can make informed decisions. Properly structured notes enhance the overall clarity and reliability of audited financial statements, making them indispensable for comprehensive financial analysis and accountability. They are integral to fulfilling reporting requirements and maintaining stakeholder trust. Explanatory notes ensure that all material information is disclosed accurately and comprehensively.

The audit process involves systematic examination of financial records to ensure accuracy, compliance, and fairness, conducted by independent auditors following established standards and methodologies. The auditor plays a critical role in ensuring the accuracy and reliability of financial statements. They examine financial records, test transactions, and evaluate internal controls to form an opinion. Auditors provide an independent verification, offering assurance that the statements present a true and fair view. Their expertise ensures compliance with accounting standards and regulatory requirements. The auditor’s role is to identify material misstatements and assess risks, ultimately enhancing the credibility of the financial statements for stakeholders. By conducting thorough audits, they contribute to transparency and trust in financial reporting, making their role indispensable in the preparation and validation process. Audit opinions are classifications provided by auditors after reviewing financial statements. The most common types include unqualified, qualified, adverse, and disclaimer opinions. An unqualified opinion indicates the financial statements are fairly presented. A qualified opinion suggests minor deviations from standards, while an adverse opinion signifies significant misrepresentation. A disclaimer opinion is issued when the auditor cannot form a conclusion due to insufficient information. These opinions significantly impact stakeholders’ decisions, as they reflect the reliability and accuracy of the financial data. An unqualified opinion enhances credibility, whereas adverse or disclaimer opinions may raise concerns among investors and creditors, potentially affecting the company’s ability to secure financing or maintain trust. Management is responsible for preparing accurate financial statements, ensuring compliance with accounting standards, and maintaining internal controls. They must provide auditors with complete and truthful information. Auditors, as independent third parties, evaluate the fairness and accuracy of the financial statements. Their role includes assessing risks, testing transactions, and forming an opinion on the statements’ reliability. Both parties must adhere to professional standards and ethical guidelines. Management’s accountability ensures data integrity, while auditors provide an objective assessment, fostering stakeholder confidence. Collaboration between management and auditors is crucial for a smooth audit process and reliable financial reporting. Preparing audited financial statements requires accurate data collection, compilation of balance sheets, income statements, and cash flow statements, followed by thorough internal checks and external auditor verification. To prepare audited financial statements, start by compiling accurate financial data and ensuring compliance with accounting standards. Organize the balance sheet, income statement, and cash flow statement. Conduct an internal review to verify data accuracy and reconcile accounts. Prepare explanatory notes to provide context for complex transactions. Engage external auditors early to discuss scope and timelines. Submit all supporting documents, such as invoices and contracts, for verification. Ensure transparency in reporting by disclosing all material information. After the audit, review the auditor’s findings and address any discrepancies. Finally, finalize and present the audited statements in a clear, standardized format for stakeholders. This process ensures credibility and compliance with regulatory requirements. Internal review and validation are critical steps before engaging external auditors. Begin by reconciling all accounts to ensure accuracy and consistency. Review financial statements for completeness and adherence to accounting standards. Validate disclosures in explanatory notes to ensure clarity and transparency. Conduct internal audits to identify and address potential discrepancies. Ensure that all transactions are properly documented and authorized. Perform trend analysis to detect unusual patterns or anomalies. Collaborate with department heads to verify data accuracy and obtain necessary approvals. Document all review processes and outcomes for auditor reference. This thorough internal validation enhances the credibility of financial statements and streamlines the external audit process, ensuring a smooth and efficient experience. Proper internal controls and checks significantly reduce the risk of material misstatements. External auditors play a pivotal role in the preparation of audited financial statements by providing an independent and objective assessment. They examine the company’s financial records, ensuring compliance with accounting standards and regulatory requirements. Auditors verify the accuracy of financial data, assess internal controls, and evaluate the reasonableness of management’s judgments. They identify and address potential risks or misstatements, providing recommendations for improvement. Through rigorous testing and analysis, auditors build confidence in the financial statements’ reliability. Their involvement enhances transparency and credibility, making the financial statements more trustworthy for stakeholders like investors and lenders. Ultimately, external auditors contribute to the integrity and accountability of the financial reporting process, ensuring that the final statements present a true and fair view of the company’s financial position and performance. Their expertise is crucial in maintaining stakeholder confidence and upholding financial integrity. Sample audited financial statements can be found on regulatory websites, company websites, and public repositories like SEC EDGAR. Many companies include them in their annual reports. Publicly available sources for audited financial statement samples include regulatory websites like the SEC EDGAR database, which hosts filings for publicly traded companies. Many companies also publish their audited financial statements in PDF format within their annual reports or investor relations sections on their official websites. Additionally, platforms like ResearchGate, Scribd, and academic repositories often provide access to sample audited financial statements for educational purposes. These documents are valuable for understanding the structure, content, and presentation of audited financials. For example, Unilever’s annual reports or the financial statements of non-profit organizations like UNICEF are often available online. These resources are widely accessible and serve as practical references for stakeholders needing examples of audited financial statements. Regulatory websites and repositories are reliable sources for accessing sample audited financial statements in PDF format. The SEC’s EDGAR database, for instance, provides comprehensive filings, including annual reports and audited financials of publicly traded companies. Similarly, regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) host audited financial statements for entities under their jurisdiction. These platforms offer free access to real-world examples, allowing users to review the structure, disclosures, and compliance aspects of audited financials. Such repositories are invaluable for professionals, students, and researchers seeking practical insights into audited financial statements. Many companies publish their audited financial statements in PDF format on their official websites, often within their investor relations or financial sections. Annual reports, which include audited financials, are commonly available for download. For example, companies like Unilever and Biopekárna Zemanka provide detailed annual reports with audited statements. These documents typically include the balance sheet, income statement, cash flow statement, and explanatory notes. They offer valuable insights into a company’s financial health and are readily accessible to the public. Professionals and researchers often use these resources to review real-world examples of audited financial statements, ensuring compliance with accounting standards and regulatory requirements. This practice promotes transparency and accountability. Analyzing audited financial statements involves reviewing financial ratios, performing trend analysis, and identifying red flags to assess a company’s financial health and performance for stakeholders. Financial ratios and metrics are critical tools for analyzing audited financial statements. They provide insights into a company’s liquidity, profitability, and solvency. Common ratios include the current ratio, gross margin, and debt-to-equity ratio. These metrics help stakeholders assess financial health, operational efficiency, and risk levels. By examining trends and benchmarking against industry standards, users can identify areas of strength and concern. For example, a high current ratio may indicate strong liquidity, while a declining gross margin could signal rising costs or pricing pressures. Metrics also reveal long-term sustainability, such as debt repayment capacity. Understanding these ratios enables informed decision-making for investors, creditors, and management, ensuring resources are allocated effectively and risks are mitigated. Regular analysis of these metrics is essential for maintaining financial stability and achieving strategic goals. Trend analysis involves examining financial data over multiple periods to identify patterns and changes in performance. Benchmarking compares a company’s financial metrics to industry standards or competitors. Both tools enhance decision-making by highlighting strengths, weaknesses, and areas for improvement. Audited financial statements provide reliable data for these analyses, ensuring accuracy and consistency. Trend analysis reveals improvements or deteriorations in financial health, while benchmarking helps assess competitive positioning. Together, they enable stakeholders to evaluate past performance, predict future trends, and align strategies with industry norms. By leveraging audited financial statements, businesses can conduct meaningful trend analysis and benchmarking to drive growth and maintain financial stability. When analyzing audited financial statements, identifying red flags is crucial for assessing risks and ensuring sustainability. Red flags may include significant debt increases, declining cash flows, or unexplained variances in financial ratios. Stakeholders should review trends in profitability, asset utilization, and liquidity to detect potential issues. Auditors often highlight areas of concern, such as material weaknesses in internal controls or uncertain accounting treatments. Unexplained deviations from industry norms or benchmarks may signal underlying problems. Proactive identification of these red flags enables timely corrective actions, safeguarding stakeholders’ interests and promoting financial stability. Regular audits ensure transparency, helping to mitigate risks and address vulnerabilities effectively. Always ensure accuracy and compliance with accounting standards. Maintain transparency in reporting to build stakeholder trust. Avoid common mistakes like incomplete disclosures or unsupported assumptions. Ensuring accuracy and compliance in audited financial statements involves meticulous preparation and adherence to accounting standards. Companies must maintain detailed records and ensure all transactions are properly documented. Regular internal audits and reviews help identify discrepancies early, preventing material misstatements. Compliance with regulatory requirements, such as GAAP or IFRS, is non-negotiable. External auditors play a crucial role in verifying the accuracy of financial data, providing an independent opinion on the fairness of the statements. Management should foster a culture of transparency and integrity, encouraging employees to report any inconsistencies. By following these practices, organizations can uphold the reliability and credibility of their financial reports, building trust among stakeholders. Transparency in reporting is a cornerstone of audited financial statements, ensuring that stakeholders have clear and unbiased insights into a company’s financial standing. By presenting detailed and accurate information, businesses demonstrate accountability and build trust with investors, creditors, and regulatory bodies. Audited statements require companies to disclose all material transactions and events, preventing the omission of critical details. This level of openness ensures that stakeholders can make informed decisions based on a true and fair representation of the company’s financial health. Transparency also fosters credibility, as audited statements undergo rigorous scrutiny by independent auditors, further enhancing their reliability and integrity. Avoiding common mistakes in audited financial statements is crucial for maintaining accuracy and credibility. One frequent error is the misclassification of assets, liabilities, or equity, which can distort the financial position. Another mistake is the incorrect valuation of inventories or accounts receivable, leading to misleading financial performance. Timeliness is also critical; delayed reporting or incomplete disclosures can undermine stakeholder confidence. Additionally, failing to adhere to accounting standards or regulatory requirements can result in non-compliance issues. To avoid these pitfalls, thorough internal reviews, clear documentation, and collaboration with auditors are essential. Ensuring that all financial data is accurate, complete, and presented transparently helps prevent errors and strengthens the reliability of the audited statements. Audited financial statements are essential for building trust and ensuring accountability. They provide a reliable foundation for decision-making and demonstrate a commitment to financial integrity and transparency. Audited financial statements are a cornerstone of trust and accountability in business. They ensure transparency, compliance, and accuracy, providing stakeholders with reliable data for informed decision-making. By validating the integrity of financial records, audits build confidence among investors, lenders, and regulators. The independent perspective of auditors adds credibility, helping to identify risks and errors. Regular audits foster a culture of accountability, encouraging organizations to maintain high standards of financial reporting. In essence, audited financial statements are vital for sustaining trust and ensuring the integrity of financial markets. They play a critical role in promoting fairness and transparency, making them indispensable for businesses of all sizes and industries. Stakeholders should recognize the critical role of audited financial statements in ensuring transparency and accountability. These documents provide reliable insights into a company’s financial health, enabling informed decision-making. Investors and lenders rely on audited statements to assess risks and opportunities, while regulators use them to verify compliance with legal standards. The independent verification by auditors adds credibility, highlighting the accuracy and fairness of financial reporting. Stakeholders should also understand that audited statements help identify potential risks and areas for improvement, fostering trust and confidence in the organization. Ultimately, audited financial statements are essential for maintaining stakeholder trust and ensuring the long-term sustainability of a business.

The Audit Process

Role of the Auditor in Preparing Audited Financial Statements

Types of Audit Opinions and Their Implications

Responsibilities of Management and Auditors

How to Prepare Audited Financial Statements

Steps to Prepare Audited Financial Statements

Internal Review and Validation Processes

Role of External Auditors in the Preparation Process

Where to Find Sample Audited Financial Statements

Publicly Available Sources for Sample PDFs

Regulatory Websites and Repositories

Company Websites and Annual Reports

Analysis and Interpretation of Audited Financial Statements

Understanding Financial Ratios and Metrics

Trend Analysis and Benchmarking

Identifying Red Flags and Areas of Concern

Best Practices for Using Audited Financial Statements

Ensuring Accuracy and Compliance

Transparency in Reporting

Avoiding Common Mistakes

Final Thoughts on the Importance of Audited Financial Statements

Key Takeaways for Stakeholders